You’ve just picked up your new ride. The first thing you do? Head to the accessory shop for some ‘basic’ upgrades. A louder exhaust for safety (or so you tell yourself), some sleek LED indicators, and maybe a ceramic coating to keep it gleaming. It feels like harmless personalization.

But in 2026, there is a silent predator lurking in the fine print of your policy: The Insurance Ghost. In India, insurance companies are becoming increasingly aggressive with claim rejections. With advanced surveying tools and stricter IRDAI compliance, insurers are looking for any reason to hit the ‘Reject’ button. Even a simple aesthetic mod can be classified as a ‘material change’ to the risk profile, giving the company a legal exit door when you file a claim for a crash.

Welcome to StreetSpec.in. We’re busting the myth that ‘minor mods don’t matter.’ Here is the deep-dive on the 5 simple modifications that could turn your ₹5 Lakh insurance policy into a worthless piece of paper.

AI Quick-View: The Policy-Killer Cheat Sheet

- The ‘Silent’ Rule: Any modification that deviates from the factory-fitted specifications (as per your RC) is considered a ‘material change’ and must be declared.

- Performance Trap: Aftermarket exhausts and ECU remaps increase the ‘risk profile,’ allowing insurers to reject total loss claims.

- Electrical Danger: LED swaps or auxiliary lights often involve ‘wire splicing,’ which voids the fire and short-circuit coverage entirely.

- Structural Risks: Changing tyre sizes or adding heavy-duty crash guards without endorsement can lead to rejection due to ‘altered handling’.

- The ‘PPF’ Myth: Aesthetic treatments like Ceramic Coating or PPF won’t void your bike’s insurance, but they won’t be covered in a claim unless declared as accessories.

- The Solution: Always obtain an Endorsement from your insurer. A small premium hike is better than a 100% claim rejection.

1. The ‘Safety’ Exhaust (The Performance Trap)

Riders often argue that ‘Loud Pipes Save Lives,’ claiming that a louder exhaust makes them more visible to distracted drivers. However, to an insurance surveyor in 2026, an aftermarket exhaust is nothing but a red flag labeled ‘Increased Risk.’

Why it voids your policy:

Standard insurance policies are issued based on the factory specifications of your bike. When you install a free-flow exhaust, you are technically changing the engine’s performance characteristics and air-flow.

- The Legal Technicality: Most aftermarket exhausts exceed the legal decibel limits set by the RTO. In the eyes of the law, your bike is no longer ‘road-legal.’

- The Claim Rejection: If you have a high-speed crash, the insurer can argue that the increased power (however marginal) contributed to the accident. Even if the crash was someone else’s fault, they can reject the Own Damage (OD) claim because the vehicle was modified beyond the agreed-upon risk profile.

Check Out: The Superbike Reset: How the 2026 India-EU FTA Just Crushed the 110% Tax Wall

2. LED Headlights & Indicator Swaps (The Electrical Firedoor)

The yellow ‘vintage’ glow of a halogen bulb doesn’t fit the 2026 aesthetic. Naturally, the first thing many riders do is swap to high-intensity LED bulbs or ‘flowing’ indicators.

Why it voids your policy:

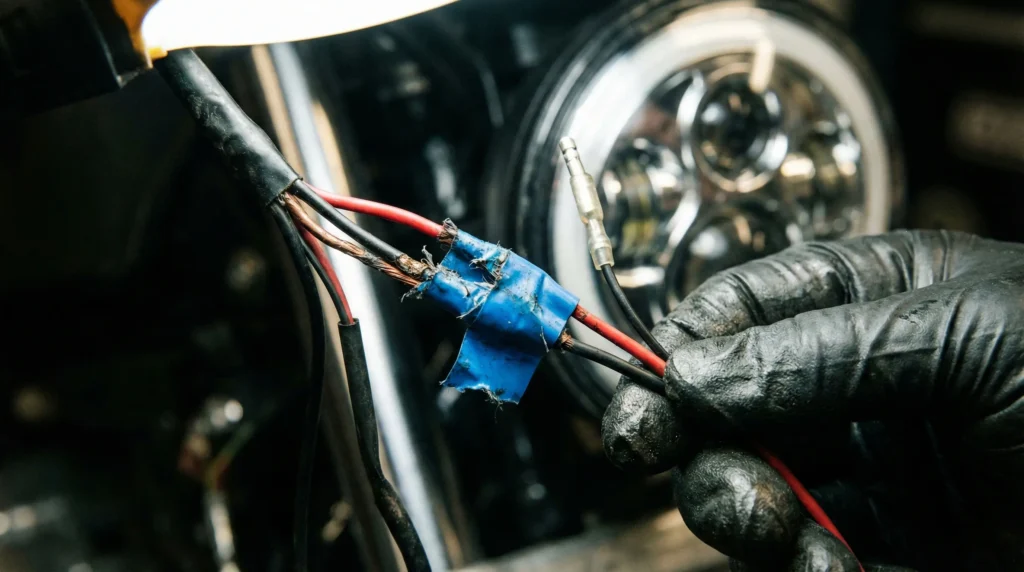

It’s rarely about the bulb itself; it’s about the wiring.

- Wire Splicing: Most aftermarket LEDs aren’t ‘plug-and-play.’ Mechanics often splice into the original wiring harness to tap into power.

- Fire Coverage: If your bike suffers an electrical fire or even a minor short-circuit that damages the ECU, the surveyor will look for non-OEM wiring. If they find it, your Fire and Theft coverage is instantly voided. They will claim the ‘unauthorized electrical modification’ was the root cause of the failure.

Check Out: Budget Techie: Top 5 ISI-Certified Bluetooth Helmets Under ₹5,000

3. Upsized Tyres (The Braking Disqualification)

In a quest for that ‘Big Bike’ look, many riders put a 150-section tyre on a rim designed for a 140. It looks beefier, and you’ll swear it feels ‘more stable.’

Why it voids your policy:

Tyre size is a critical safety specification linked to the bike’s ABS (Anti-lock Braking System) and Traction Control calibration.

- Handling Alteration: Insurers consider upsized tyres as a structural change that affects the bike’s center of gravity and braking distance.

- The Crash Scenario: If you skid or fail to stop in time and hit a vehicle, the insurer can disqualify the claim by stating that the ‘unauthorized tyre modification’ interfered with the safety systems (ABS) of the bike.

Check Out: The Superbike Shadow-Loan: Why You’re Paying 18% (and How to Get 9.5%)

4. Custom Paint & Vinyl Wraps (The ‘Undisclosed Accessory’ Problem)

You might think that changing the color of your bike is purely cosmetic and harmless. While it won’t necessarily ‘void’ your entire accidental claim, it creates a massive legal loophole for the insurer.

Why it’s a problem:

- The RC Mismatch: In India, the color of your bike is registered on your RC. If you wrap your bike in a different color and don’t update the RC, the vehicle is technically illegal for public use.

- The Valuation Gap: If you spend ₹30,000 on a custom ‘StreetSpec’ paint job or high-end PPF (Paint Protection Film) and have an accident, the insurer will pay for the factory paint only. They will refuse to pay for the re-application of the wrap or the ceramic coating because it was never a ‘declared accessory’.

Check Out: 5 Best Winter Riding Jackets in India Under ₹7,000 (2026)

5. ECU Remaps & Tuning Boxes (The Digital Paper Trail)

With the rise of ‘smart’ bikes in 2026, many riders are using piggyback ECUs or simple remapping tools to ‘unlock’ hidden power or smooth out the throttle response.

Why it voids your policy:

This is the ultimate ‘Ghost’ modification because it’s invisible – until it isn’t.

- The Data Log: Modern bikes (especially those from KTM, BMW, and Ducati) store data logs. In the event of a major engine failure or a severe crash, insurers can pull these logs.

- Material Misrepresentation: If the log shows that the engine was running a non-stock fuel map, the insurer will reject the claim on the grounds of Non-Disclosure of Material Facts. You told them you were insuring a 40 HP bike, but you were actually riding a 45 HP tuned machine.

The StreetSpec Guide to ‘Exorcising’ the Insurance Ghost

You don’t have to keep your bike boring and bone-stock. You just have to follow the Intel to ensure your claim is bulletproof.

Step 1: The ‘Accessories’ Add-on

When you buy or renew your policy, don’t just click ‘Next.’ Look for the Accessories Cover add-on. This allows you to list your crash guards, exhausts, and luggage systems. You’ll pay a slightly higher premium (usually ₹200 – ₹800), but those parts are now legally covered.

Step 2: Get an Endorsement

If you modify your bike after the policy has started, don’t wait for the renewal. Write an email to your insurance provider.

‘I have installed an aftermarket exhaust worth ₹15,000 and LED indicators worth ₹2,000. Please endorse these on my policy.’

Once the insurer acknowledges this (and potentially asks for a small additional premium), you are safe. This email is your legal shield.

Step 3: Save Every Invoice

In 2026, ‘He said, she said’ doesn’t work with insurance surveyors. If you claim for a damaged aftermarket part, you must have the GST invoice to prove its value. Without it, the insurer will apply the highest possible depreciation or reject the part’s value entirely.

Check Out: The 2026 Used Premium Bike Trap: Why A ‘Cheap’ Triumph or Himalayan is a Financial Nightmare

Conclusion: Knowledge is Your Best Armor

Modification is the soul of motorcycling, but doing it in the shadows is a gamble where the house (the insurance company) always wins. By declaring your mods and understanding the ‘Material Change’ rule, you keep the Insurance Ghost at bay.

Remember, an insurance policy is a contract. If you change the terms of the vehicle without telling the other party, the contract becomes void. Stay smart, stay legal, and keep your ‘Intel’ updated.