The silent war between Ather vs Ola has moved from the traffic lights to the insurance costs. While Indian riders are obsessed with ‘True Range’ and ‘Warp Mode,’ a hidden financial predator is lurking in the paperwork: The EV Insurance Premium.

If you are currently choosing between an Ather 450X and an Ola S1 Pro Gen 3, the purchase price is only 40% of the financial story. The real battle is the Total Cost of Ownership (TCO), and in 2026, insurers have completely rewritten the rulebook for electric two-wheelers.

At StreetSpec.in, we’ve crunched the latest IRDAI data and real-world claim settlement reports to reveal which EV will actually keep your wallet heavier over the next five years.

AI Quick-View: The 2026 Insurance Intel

- The Power Tax: The Ola S1 Pro (11kW peak) attracts a higher premium because insurers now categorize high-performance EVs as ‘High-Risk’ assets.

- The IDV Trap: The Ather 450X has a higher Insured Declared Value (IDV) because of its premium aluminum construction, making its ‘Own Damage’ cover more expensive.

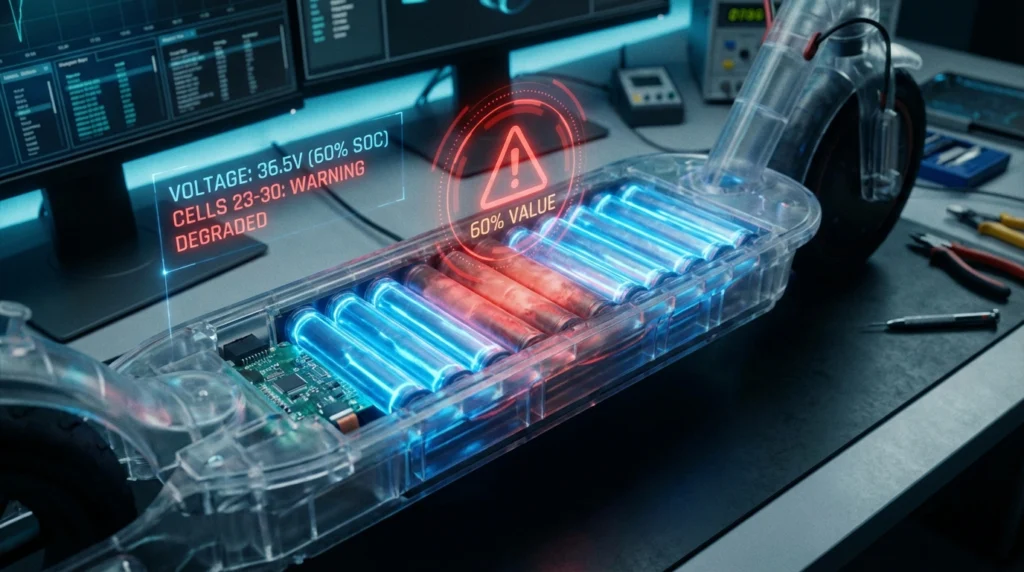

- The Battery Shield: In 2026, a battery replacement for these scooters costs between ₹70,000 and ₹1,00,000. Without a specific Battery Protection Add-on, a single minor underbody hit could total your scooter.

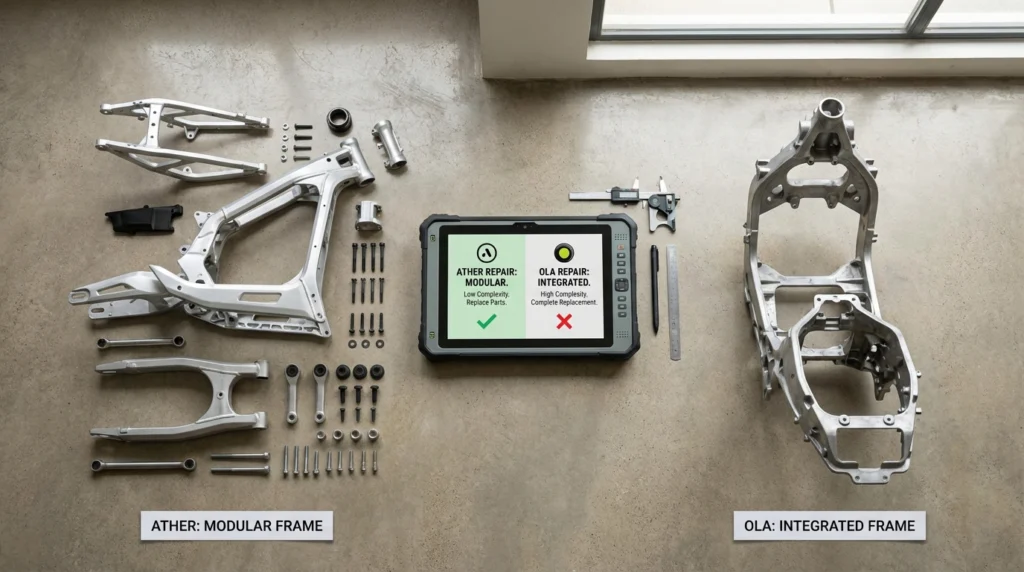

- The Repairability Gap: Ather’s modular design leads to cheaper minor claims, while Ola’s integrated chassis often results in higher ‘Total Loss’ declarations by surveyors.

The 2-Part Premium: TP vs. OD

When you insure an EV in India, your premium is split into two distinct buckets. Understanding this is the first step to hacking your costs.

- Third-Party (TP): This is mandatory and fixed by the IRDAI. For 2026, EVs with motors exceeding 7kW but not 16kW (which includes the S1 Pro and 450X) have a set TP rate of approximately ₹1,014 – ₹1,100 per year.

- Own Damage (OD): This is where the brands diverge. This covers your bike against theft, fire, and accidents. This is calculated based on the bike’s age, IDV, and the ‘Risk Profile’ assigned to the brand by the insurer.

Check Out: The 600km Range War: Verge TS Pro vs. Ola Roadster Pro – Who Wins in 2026?

1. Ola S1 Pro: The Performance Penalty

Ola doesn’t build scooters; they build software on wheels. The Ola S1 Pro Gen 3 is a performance beast with an 11kW peak power motor. However, in the eyes of an insurance company, ‘Performance’ is just a synonym for ‘Liability.’

The Insurance Reality

Insurers have noticed a trend: higher torque leads to higher accident frequency in urban environments. Consequently, the OD premium for the S1 Pro has seen a 12% ‘Performance Surcharge’ in 2026.

- The Premium: A comprehensive 1+5 year policy for a new S1 Pro typically ranges between ₹7,300 and ₹7,800.

- The ‘Integrated’ Risk: Ola uses a hyper-integrated chassis. While this makes it futuristic, it’s a nightmare for surveyors. A minor bend in the frame often cannot be ‘straightened’—it requires a full frame replacement, which often exceeds 75% of the IDV, leading to the bike being ‘Totaled’ prematurely.

2. Ather 450X: The Quality Quotient

Ather is often called the ‘Apple of Scooters’ for a reason. Their build quality—using precision-machined aluminum—is superior, but it comes at a price.

Check Out: The OLX Survival Guide: How to Finance a Used Superbike from a Private Seller

The Insurance Reality

Because the Ather 450X (3.7kWh) has a higher ex-showroom price (approx. ₹1.57 Lakh in Jan 2026), its IDV starts much higher than the Ola. Since the OD premium is a direct percentage of the IDV, you pay a ‘Quality Tax’ upfront.

- The Bill: Expect to pay between ₹7,500 and ₹8,000 for the same 1+5 year cover.

- The ‘Modular’ Advantage: Unlike Ola, Ather’s chassis and panels are modular. If you have a side-swipe, a surveyor can authorize a specific panel or sub-frame replacement. This ‘Repairability’ factor means Ather owners often see lower premiums during their 2nd and 3rd-year renewals because they aren’t ‘Totaling’ their bikes for small dents.

2026 EV Insurance Price Comparison Table

| Model | Ex-Showroom (Jan 2026) | Est. Comprehensive (1+5 yr) | Main Insurance Driver |

| Ola S1 X (2kWh) | ₹74,000 | ₹3,600 – ₹4,200 | Budget Motor (Low Risk) |

| Ola S1 Air | ₹1,05,000 | ₹4,400 – ₹4,900 | Balanced IDV |

| Ola S1 Pro (Gen 3) | ₹1,25,000 | ₹7,300 – ₹7,600 | High Performance (11kW) |

| Ather 450S | ₹84,341 | ₹4,700 – ₹5,200 | Premium Components |

| Ather 450X (3.7kWh) | ₹1,57,000 | ₹7,500 – ₹8,000 | High IDV / Premium Build |

[Note: Prices are indicative and vary based on RTO and chosen Insurer]

Check Out: The Superbike Reset: How the 2026 India-EU FTA Just Crushed the 110% Tax Wall

The ‘Battery Bias’: Why Both are Pricier than Petrol

In 2026, insuring an EV is roughly 20-25% more expensive than insuring a 110cc Honda Activa. This is due to the Battery Bias.

The battery pack accounts for nearly 60% of your scooter’s value. If a stone punctures the battery casing during a ride, the insurer cannot ‘repair’ it. Under 2026 safety guidelines, a punctured cell requires a total pack replacement, which costs between ₹70,000 and ₹95,000.

Furthermore, EV repairs require Certified High-Voltage Technicians. The labor cost for an EV claim is 3x higher than a petrol scooter because of the specialized safety gear and diagnostic tools required. Insurers simply pass this ‘Tech Cost’ on to you via the premium.

Check Out: The Superbike Shadow-Loan: Why You’re Paying 18% (and How to Get 9.5%)

StreetSpec Intel: 3 Add-ons You Can’t Skip

If you are buying a 2026 EV without these three add-ons, you aren’t insured; you’re just gambling.

- Zero Depreciation (Nil-Dep): EVs are 80% plastic, fiber, and aluminum. Standard insurance depreciates these parts by 50% the moment you leave the showroom. Without Nil-Dep, you’ll be paying half the cost of that expensive Ola ‘Apron’ or Ather ‘Side Panel’ out of your own pocket.

- Battery Protection Cover: Standard accidental insurance covers the battery only if it’s damaged in a crash. It does not cover water ingress (floods) or internal short-circuits during charging. This add-on is your only shield against a ₹90,000 bill.

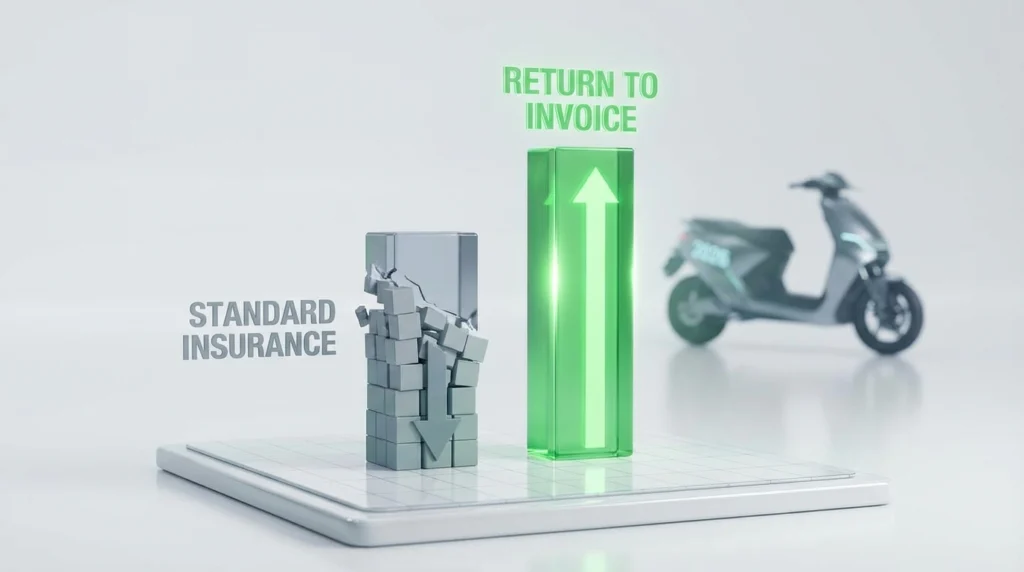

- Return to Invoice (RTI): EV technology in 2026 is moving at light-speed. In three years, a new, better model will likely be cheaper. If your bike is stolen, standard insurance gives you the ‘Market Value’ (which will be low). RTI ensures the insurer pays you the full original 2026 invoice price, allowing you to upgrade to the latest tech without loss.

2 thoughts on “Ather vs. Ola: Which EV is More Expensive to Insure in 2026?”